In the world of loans and financing, balloon payments are a unique repayment feature that can significantly impact how borrowers manage their debt. Understanding what a balloon payment is, how it works, and its pros and cons is vital for anyone considering financing options that include this structure.

This comprehensive guide explains what balloon payments are, the types of loans they are associated with, their advantages and risks, and how borrowers can best navigate agreements that include balloon payments.

Definition: What Is a Balloon Payment?

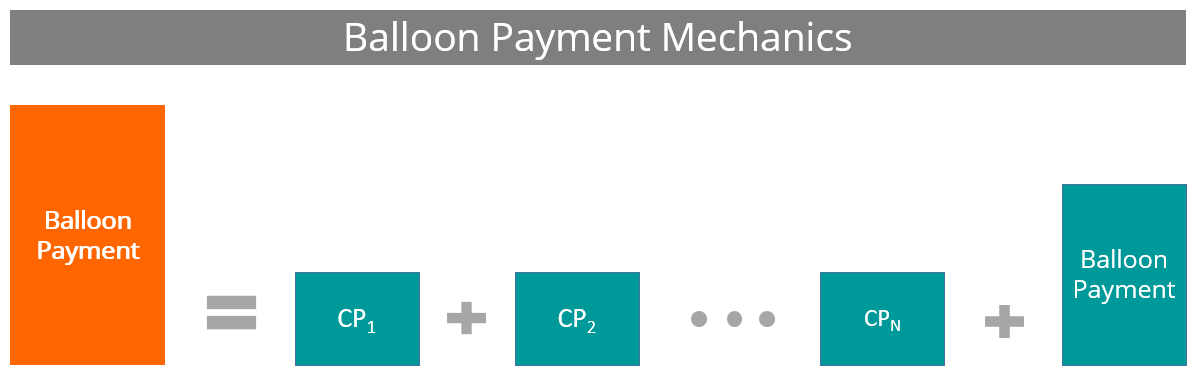

A balloon payment is a large, lump-sum payment due at the end of a loan term after a series of smaller, often lower, periodic payments. This final payment is significantly larger than the earlier installments and is used to pay off the remaining balance in full.

Unlike traditional loans with evenly amortized payments over the life of the loan, balloon loans do not fully amortize during the scheduled payment period. Instead, a substantial outstanding balance remains, which must be settled with the balloon payment.

How Do Balloon Payments Work?

When you take out a loan with a balloon payment, your monthly payments are often lower because they cover mostly interest or only a portion of the principal. The remaining principal balance accumulates and is due in one large payment at the loan’s maturity.

Example:

- Loan amount: $30,000

- Term: 5 years

- Monthly payments: Calculated based on a 20-year amortization schedule

- Balloon payment due at the end of 5 years: Remaining balance after 5 years of payments (potentially $20,000+)

The borrower is expected to either pay this lump sum outright or refinance the loan before the balloon payment due date.

Types of Loans That Often Include Balloon Payments

1. Auto Loans

Certain auto loans, especially for luxury or used vehicles, may include balloon payments. This can make monthly payments affordable but requires planning for the large payoff or trade-in later.

2. Mortgages

Some home loans—particularly interest-only mortgages or balloon mortgages—feature balloon payments. These loans offer low monthly payments early on but require a lump-sum payment at the end or refinancing.

3. Business Loans

Balloon payments are common in commercial loans or equipment financing. Businesses use this to preserve cash flow during the loan term while planning to pay the balloon amount through refinancing or asset sales.

4. Personal Loans

Though less common, some personal loans may include balloon payments as part of flexible repayment options.

Advantages of Balloon Payments

1. Lower Monthly Payments

Because monthly payments don’t fully amortize the loan, they tend to be much lower compared to traditional loans. This improves short-term cash flow.

2. Flexibility

Balloon payments can be ideal if you expect to have access to a large sum of money in the future, such as from a business sale, bonus, or refinancing options.

3. Access to Larger Loans

Borrowers can qualify for larger loans than they might otherwise afford, thanks to the lower monthly payment structure.

Risks and Considerations of Balloon Payments

1. Large Lump Sum Due

The biggest risk is the balloon payment itself—if you don’t have the funds or cannot refinance, you could face default or repossession.

2. Refinancing Uncertainty

Most borrowers plan to refinance before the balloon payment is due. However, refinancing depends on creditworthiness and market conditions, which might change.

3. Higher Overall Cost

If interest accrues on the unpaid principal, the total cost of the loan may be higher compared to fully amortized loans.

4. Potential Negative Equity

For secured loans (like auto or mortgage), if the asset value declines, you may owe more than the asset is worth at the balloon payment time.

How to Manage Balloon Payments Effectively

1. Plan Ahead

Create a financial plan for how you will handle the balloon payment—whether saving, refinancing, or selling an asset.

2. Review Loan Terms Carefully

Understand exactly how much the balloon payment will be, when it is due, and the consequences of missing it.

3. Consider Refinancing Early

Start exploring refinancing options well before the balloon payment date to avoid last-minute issues.

4. Build an Emergency Fund

If refinancing falls through, having cash reserves can prevent default and financial hardship.

When Are Balloon Payments a Good Option?

- If you have irregular or seasonal income and expect a large inflow before the payment is due

- When you want to keep monthly payments low temporarily

- If you have a clear exit strategy like selling the asset or refinancing

Frequently Asked Questions

Can I pay off the balloon payment early?

Yes, most lenders allow early payoff, but check for any prepayment penalties.

What happens if I miss the balloon payment?

Missing the balloon payment typically leads to loan default, repossession of collateral, or foreclosure depending on the loan type.

Are balloon loans riskier than traditional loans?

They can be riskier if you’re unprepared for the lump sum or unable to refinance, but manageable with good planning.

Final Thoughts

Balloon payments offer both opportunity and risk. They provide affordable monthly payments and access to larger loans, but require disciplined financial planning to handle the significant final payment.

Before agreeing to a balloon loan, carefully evaluate your ability to meet the balloon payment, understand the loan’s terms, and develop a clear strategy for repayment or refinancing.

When used wisely, balloon payments can be a valuable financial tool—but ignorance or poor planning can lead to serious financial consequences.